The 2024 Spring Budget and You

Main Headlines

Many of the changes announced in the Spring Budget would have started on April 1st 2024. The main headline from the spring budget were tax and social benefits. The most mentioned being National Insurance Contributions and Child Benefits. Here is a breakdown of what these will mean for you and your money.

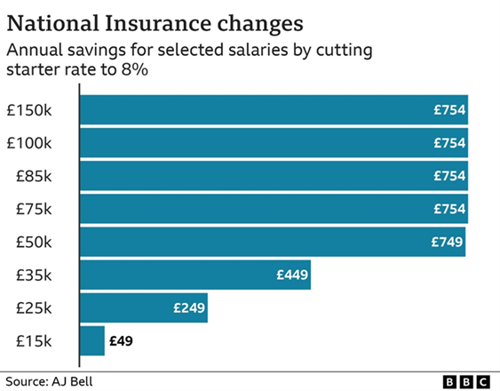

National insurance contributions are made through your payroll for those who are employed, or by income tax if self-employed. In the budget, the rate of these contributions was reduced. You will now be paying less towards your national insurance contributions and have more money on your payslip at the end of the month.

On the chart below you can get an idea of what your national insurance savings will be, based on your income:

The government have not changed tax brackets since 2021. As a result, if you earn more money this year, you may enter a new tax bracket. If this happens, you will pay more tax. This means more money to the tax man and less money on your payslip at the end of the month.

Other tax benefits announced include:

- The freeze of fuel tax duty has been extended. As a result, the average car driver will save around £50 for the year.

- Capital gains tax has been reduced from 28% to 24%. So, if you sell an item that has increased in value, the tax you pay on your profit will be less.

- The limit for VAT registration for small businesses will rise from £85,000 to £90,000. This means if you own a small business, you only need to register for VAT once your turnover is £90,000 and more. As a result, you could earn more money before you start paying VAT.

Social benefits announced include:

- Child benefits will be lost, once one parent earns over £60,000 a year before tax. Child benefit will be taken away entirely once one parent earns from £80,000 a year before tax.

- A range of benefits, such as universal credit, have increased by 6.7%. This means more money for persons who receive this benefit.

- The state pension has increased by 8.5%. So, pensioners will also receive more money.

- The National Living Wage for persons over 23 years old have increased from £10.42 an hour to £11.44 an hour.

For more information on the 2024 Spring Budget, please visit the official Government site here.